Effective January 1, 2019, through December 31, 2019 Arizona’s minimum wage will be $11.00 per hour.

Get enrollment help on Healthcare.gov – 6th Year of Service

Marketplace Service – 1-1-2018 Health Insurance Marketplace

This certificate is proudly presented to Tom Gray

In appreciation of your ongoing contribution and success during the 2018 Health Insurance Marketplace Open Enrollment. Thanks to your hard work, you have increased access to health care and made a lasting positive impact on your community.

Participating in an Adventure Sport on your upcoming international trip?

The Adventure Sports Rider is available for those up to the age of 65. The following activities are covered to the lifetime maximum amounts listed below as long as they are engaged solely for leisure, recreation, or entertainment purposes: abseiling, BMX, bobsledding, bungee jumping, canyoning, caving, hang gliding, heli-skiing, high diving, hot air ballooning, inline skating, jet skiing, jungle zip lining, kayaking, mountain biking, parachuting, paragliding, parascending, piloting a non-commercial aircraft, rappelling, rock climbing or mountaineering (ropes and guides to 4500m from ground level), scuba diving (to 50m), skydiving, snorkeling, snow boarding, snowmobiling, snow skiing, spelunking, surfing, trekking, whitewater rafting (to Class V), and wildlife safaris, and windsurfing. All such activities must be carried out in strict accordance with the rules, regulations and guidelines of the applicable Governing Body or Authority of each such activity. Certain sports activities are never covered, regardless of whether or not you purchase the Adventure Sports Rider. Please note this is only a summary of Adventure Sports and exclusions.

Patriot Travel Medical Insurance®

Short-term travel medical insurance for individuals and families. Provides coverage for individuals and families who need temporary medical insurance while traveling for business or pleasure anywhere outside of their home country.

Highlights:

- Short-term travel medical coverage

- Coverage for individuals and dependents

- Two plan designs – one for people traveling outside their home country whose destination excludes the U.S. and one for those whose destination includes the U.S.

- Maximum Limits Per Period of Coverage Options: $50,000, $100,000, $500,000, $1,000,000, $2,000,000 (Patriot International only)

- Deductible options from $0 to $2,500

- Available in daily and monthly rates

- Renewable up to 24 months

- Freedom to seek treatment with hospital or doctor of your choice

- Universal Rx pharmacy discount savings

- 24 hour secure access from anywhere in the world to manage your account at any time

Patriot Platinum Travel Medical InsuranceSM

Short-term travel medical insurance for individuals and families. Provides first-class protection for the discerning international traveler who wants to obtain the maximum coverage available in a short-term travel medical insurance product.

Highlights:

- Short-term travel medical coverage

- Coverage for individuals and dependents

- Two plan designs – one for U.S. citizens and one for non-U.S. citizens traveling outside their home country

- Maximum Limits from $1,000,000 to $8,000,000

- Deductible options from $0 to $25,000

- Available in monthly and daily rates

- Renewable up to 36 months if one month is initially purchased

- Access to Global Concierge & Assistance Services – extended services handled by a dedicated service team

- Access to board-certified physicians, licensed psychologists, pharmacist, dentists, dieticians and trainers to assist you with any routine health related questions you have

- Freedom to seek treatment with hospital or doctor of your choice

- Universal Rx pharmacy discount savings

- 12 month benefit period

- 24 hour secure access from anywhere in the world to manage your account at any time

You have enough to worry about when you’re traveling. Don’t let your medical coverage be an uncertainty.

There are transitional periods in life that can leave you without medical coverage for a brief time

Tokio Marine HCC – MIS Group understands your need for peace of mind about health insurance coverage during uncertain times. STM Complete provides affordable temporary health insurance to protect you and your family.

Tokio Marine HCC – MIS Group understands your need for peace of mind about health insurance coverage during uncertain times. STM Complete provides affordable temporary health insurance to protect you and your family.

Is STM Complete right for me? You should consider purchasing STM Complete if you are concerned about protecting yourself from the potentially high medical costs associated with an unexpected sickness or injury.

STM Complete is ideal for: Recent college graduates • Individuals between jobs • Early retirees • Recently naturalized citizens • New hires

How STM Complete Works – Most eligible expenses are subject to deductible and coinsurance. After your chosen deductible is satisfied, STM Complete will begin paying according to the coinsurance you select and up to the coverage period maximum for all eligible medical expenses. Benefits are based on usual and customary charges of the geographical area in which charges are incurred.

With STM Complete you are in control. You have the freedom to receive treatment from doctors and hospitals of your choice without incurring out of network penalties. From quote to fulfillment, STM Complete makes it quick and easy to apply and get the medical coverage you need. STM Complete gives you peace of mind.

Coverage Without Boundaries – Worry Less. Experience More.

Welcome to IMG

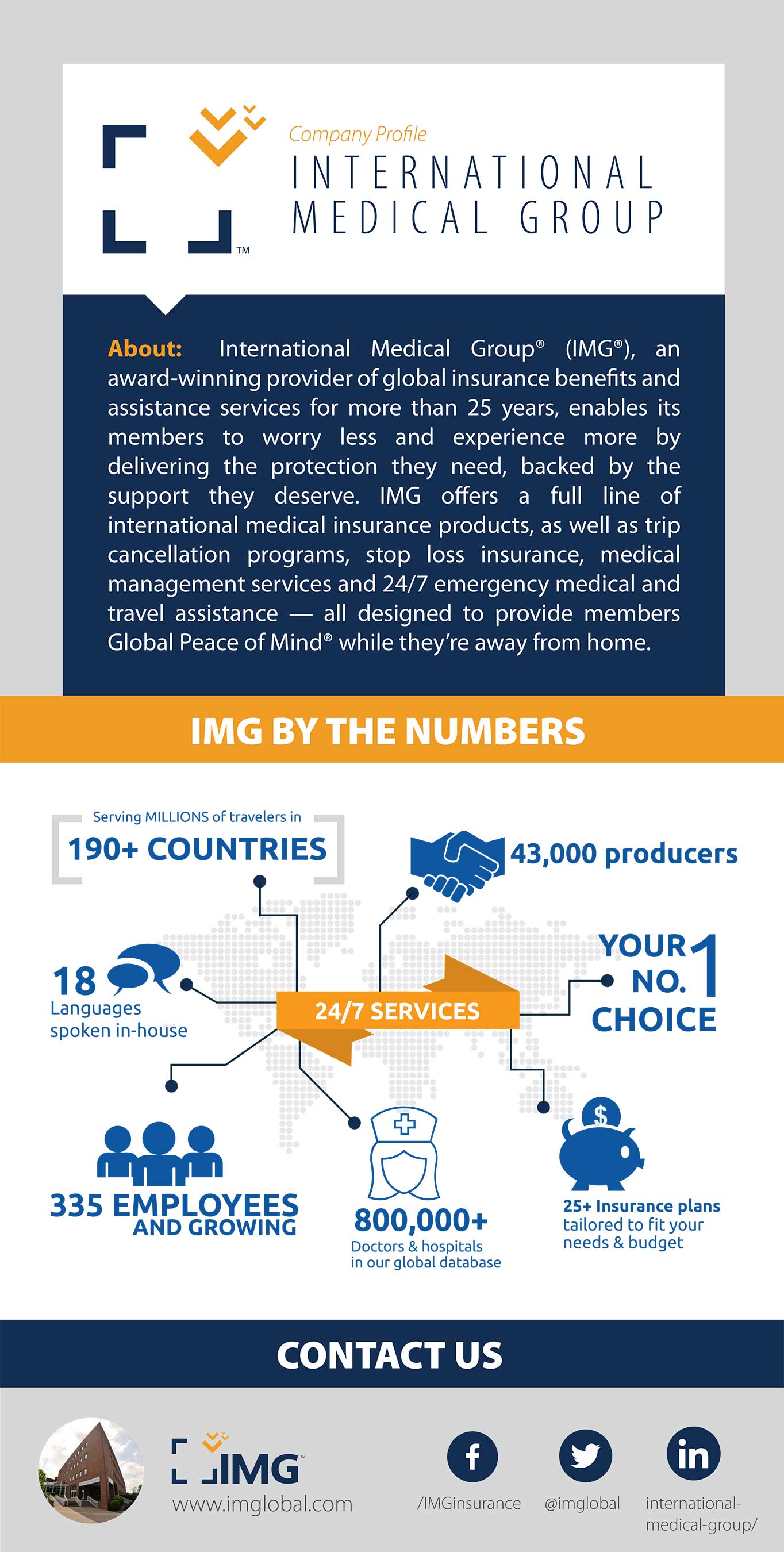

International Medical Group® (IMG®), an award-winning provider of global insurance benefits and assistance services for more than 25 years, enables its members to worry less and experience more by delivering the protection they need, backed by the support they deserve.

IMG offers a full line of international medical insurance products, as well as trip cancellation programs, stop loss insurance, medical management services and 24/7 emergency medical and travel assistance — all designed to provide members Global Peace of Mind® while they’re away from home.

Short-term travel medical insurance for individuals, families and groups from 5 days to 2 years.

Quote/Purchase Patriot Travel Medical Insurance®

- Most popular travel medical insurance plan

- Coverage for the sudden recurrence of pre-existing conditions for U.S. citizens

- Extensive range of deductibles and plan maximums

- Medical expenses, evacuation, and repatriation benefits

Global Peace of Mind – Wherever your travels take you, we’re there with you – delivering worldwide coverage, multilingual capabilities, international claims specialists, and 24-hour access to IMG. That’s medical security. That’s Global Peace of Mind. That’s IMG.

GlobeHopper® Senior – Individual & spouse short-term travel medical insurance for travelers age 65+

GlobeHopper® Senior addresses the insurance needs of U.S. citizens and U.S. permanent resident seniors who need temporary medical insurance while traveling outside the U.S. In addition to medical benefits, the plan includes coverage for emergency medical and political evacuation, repatriation, and a choice of deductibles and plan maximums up to $1,000,000.

Quote/Purchase GlobeHopperSM Senior Single-Trip

Quote/Purchase GlobeHopperSM Senior Multi-Trip

Senior Single-Trip helps protect travelers who need travel medical insurance coverage from five days up to 12 months while on a single trip.

Senior Multi-Trip offers flexible protection to frequent travelers who prefer to purchase an annual plan to cover multiple trips throughout a 12-month period, with each trip covered up to 30 days maximum.

Local Health Insurance Broker, Recognized as Nationwide Top Performer

Centers for Medicare & Medicaid Services (CMS) Office of Communications

Champions Circle Press Release – 12-1-2016 Health Insurance Marketplace

This certificate is proudly presented to Tom Gray

In appreciation of your ongoing contribution and success during the 2017 Health Insurance Marketplace Open Enrollment. Thanks to your hard work, you have increased access to health care and made a lasting positive impact on your community.

International Medical Group Unveils New Logo and Branding

PR Newswire, INDIANAPOLIS (Dec. 1, 2016) — International Medical Group® (IMG®), a leader in global benefits and assistance services, today announced the company’s new corporate branding and logo.

“After more than 25 years as a leader in the industry, it was time to refresh our brand identity,” said IMG President and CEO Todd A. Hancock. “The new logo reflects IMG’s focus on providing a foundation of security, health and well-being for our members while they’re away from home.”

IMG’s constituents — members, intermediaries, partners and employees — are represented by the logo’s four inverted angles. These angles are symbolic of a flock of Arctic terns, birds whose annual migration is the longest of any animal in the world.

A symbol of global mobility, the Arctic tern signifies the passage associated with traveling, working and living internationally. A more vibrant color palette complements the new logo, bringing to life the bright future ahead for IMG, and the world of opportunities the company provides.

In its entirety, IMG’s new logo serves as a visual representation of the company’s mission to protect and enhance the health and well-being of its constituents. The company will continue to operate under this mantra, with the goal of providing Global Peace of Mind® to its members.

About International Medical Group

International Medical Group® (IMG®), an award-winning provider of global insurance benefits and assistance services for more than 25 years, enables its members to worry less and experience more by delivering the protection they need, backed by the support they deserve. IMG offers a full line of international medical insurance products, as well as trip cancellation programs, stop loss insurance, medical management services and 24/7 emergency medical and travel assistance — all designed to provide members Global Peace of Mind® while they’re away from home.

Blue Cross Blue Shield of Arizona / IHC Short Term Medical

When to get short-term coverage?

Interim Coverage can give you short-term protection for as few as 30 days or as many as 364 and can begin as soon as the day after you’re approved. Here are a few examples of when to consider this type of health plan:

- If you didn’t buy health insurance during the annual Open Enrollment Period

- Don’t have another affordable health insurance option

- Enrolled in an annual plan, but the effective date isn’t until the next month

- If you started a new job and there’s a waiting period before your benefits begin

If this type of plan sounds right for you, apply online here –> and get coverage fast—in many cases, starting the day after you’re approved. You can get coverage for as few as 30 days or as many as 364—it’s up to you.

THIS IS A SHORT-TERM HEALTH BENEFIT PLAN THAT IS NOT INTENDED TO QUALIFY AS THE MINIMUM ESSENTIAL COVERAGE REQUIRED BY THE AFFORDABLE CARE ACT (ACA). UNLESS YOU PURCHASE A PLAN THAT PROVIDES MINIMUM ESSENTIAL COVERAGE IN ACCORDANCE WITH THE ACA, YOU MAY BE SUBJECT TO A FEDERAL TAX PENALTY. ALSO, THE TERMINATION OR LOSS OF THIS POLICY DOES NOT ENTITLE YOU TO A SPECIAL ENROLLMENT PERIOD TO PURCHASE A HEALTH BENEFIT PLAN THAT QUALIFIES AS MINIMUM ESSENTIAL COVERAGE OUTSIDE OF AN OPEN ENROLLMENT PERIOD. THIS POLICY INCLUDES A PRE-EXISTING CONDITION EXCLUSION PROVISION.

Blue Cross and Blue Shield of Arizona does not underwrite, insure or administer the insurance plans described in this brochure. The insurance plans described in this brochure are underwritten by Standard Security Life Insurance Company of New York, a member of The IHC Group. There is no ownership affiliation between Standard Security Life, The IHC Group or Blue Cross and Blue Shield of Arizona. Standard Security Life and The IHC Group are independent companies that underwrite, insure and/or administer the insurance plans described in this brochure. Blue Cross and Blue Shield of Arizona contracts with The IHC Group to make the insurance plans described in this brochure available to customers who wish to purchase a short-term medical product.

I have medical insurance in my home country, do I need Atlas MultiTrip™ medical insurance?

Many times the primary medical insurance in your home country will not cover you while traveling abroad and often will not provide essential services in the event of an illness or injury.

Atlas MultiTrip™ from MIS Group, a member of Tokio Marine HCC, is with you almost anywhere you may travel internationally for vacation, business, visits with family, sports adventures or other pursuits. Medical expenses can be very costly while abroad.

Atlas MultiTrip™ provides important benefits such as translation assistance during treatment, doctor and hospital referrals, and assistance replacing lost prescriptions. Coverage applies to multiple trips up to 30 or 45 days in length (as elected) during the 364-day contract period.

Past members have encountered more than $100,000 in expenses for an emergency medical evacuation. At $200 for a 364-day Atlas MultiTrip™ policy ($250 deductible, $1 million maximum), can you afford not to have coverage? That’s just 55 cents a day.

MIS Group, headquartered in the United States in Indianapolis, Indiana, is a full-service company offering international medical insurance and short-term medical insurance products designed to meet needs of consumers worldwide. MIS Group, a leading Specialty Insurance group.